Introduction

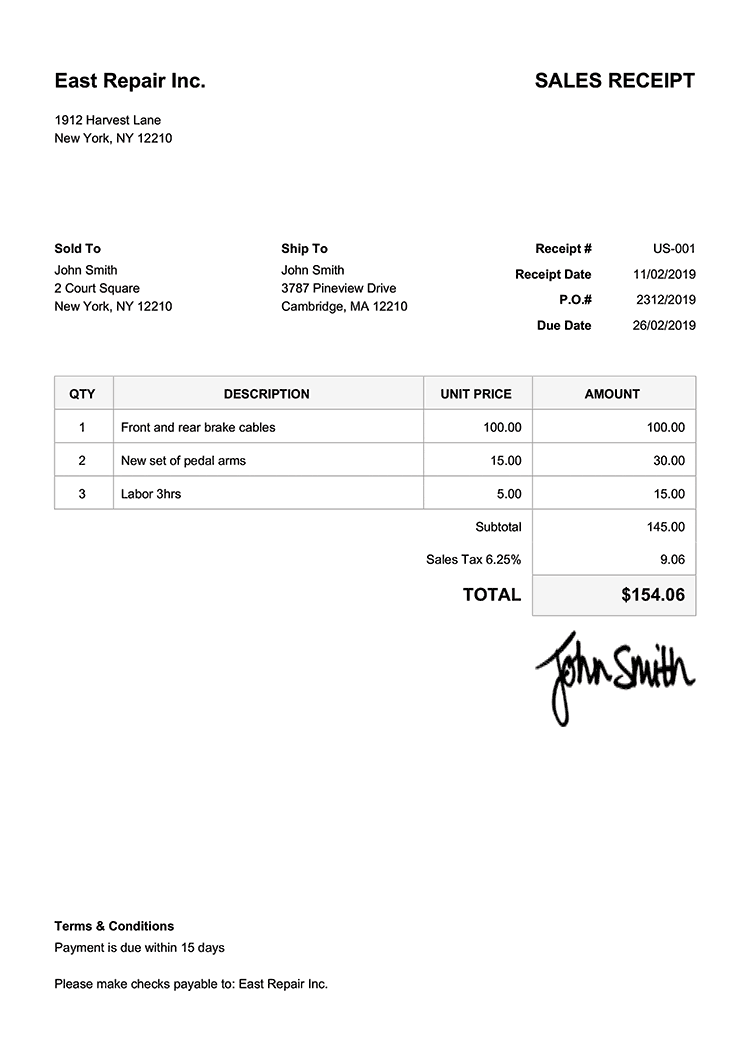

A sales receipt is a crucial document that serves as proof of purchase. It provides essential details about the transaction, including the items bought, quantity, price, and total amount paid. For businesses, sales receipts are vital for tracking sales, managing inventory, and calculating taxes.

Key Components of a Sales Receipt

A standard sales receipt typically includes the following elements:

Header: This section contains the business’s name, logo, contact information, and the receipt number.

Image Source: invoicehome.com

Types of Sales Receipts

There are several types of sales receipts, each with its own specific purpose:

Retail Receipt: Issued by retail stores for purchases made by individual consumers.

Tips for Creating Effective Sales Receipts

To ensure that your sales receipts are clear, professional, and easy to understand, consider the following tips:

Use clear and concise language. Avoid technical jargon that may confuse customers.

Conclusion

Sales receipts are essential documents that provide proof of purchase and help businesses track sales and manage inventory. By following the guidelines outlined in this article, you can create effective sales receipts that are easy to understand and professional in appearance.

FAQs

1. What is the difference between a receipt and an invoice?

A receipt is typically issued at the time of purchase and acknowledges the receipt of goods or services. An invoice, on the other hand, is a more formal document that is sent to customers for goods or services that have been delivered or provided on credit.

2. Can I use a sales receipt as proof of purchase for a warranty claim?

Yes, a sales receipt is often required as proof of purchase when making a warranty claim.

3. Is it necessary to include the customer’s signature on a sales receipt?

While not always required, including the customer’s signature can help to verify that the correct person received the goods or services.

4. Can I request a copy of a sales receipt if I have lost the original?

Most businesses will be able to provide you with a copy of a sales receipt upon request.

5. What information should I include on a sales receipt for tax purposes?

The sales receipt should include the date of the transaction, the name and address of the business, the name and address of the customer, and a detailed list of the items purchased, along with their prices and any applicable taxes.

Sales Receipt Sample