Introduction

Creating a solid budget is essential for any nonprofit organization. It’s a financial roadmap that helps you plan, track, and manage your resources effectively. A well-structured budget can also improve your organization’s credibility and attract potential donors. In this guide, we’ll walk you through the process of creating a nonprofit budget template.

Understanding Your Nonprofit’s Goals and Mission

Before diving into the template, it’s crucial to have a clear understanding of your nonprofit’s goals and mission. This will help you align your budget with your organization’s priorities. Ask yourself:

What are your organization’s primary objectives?

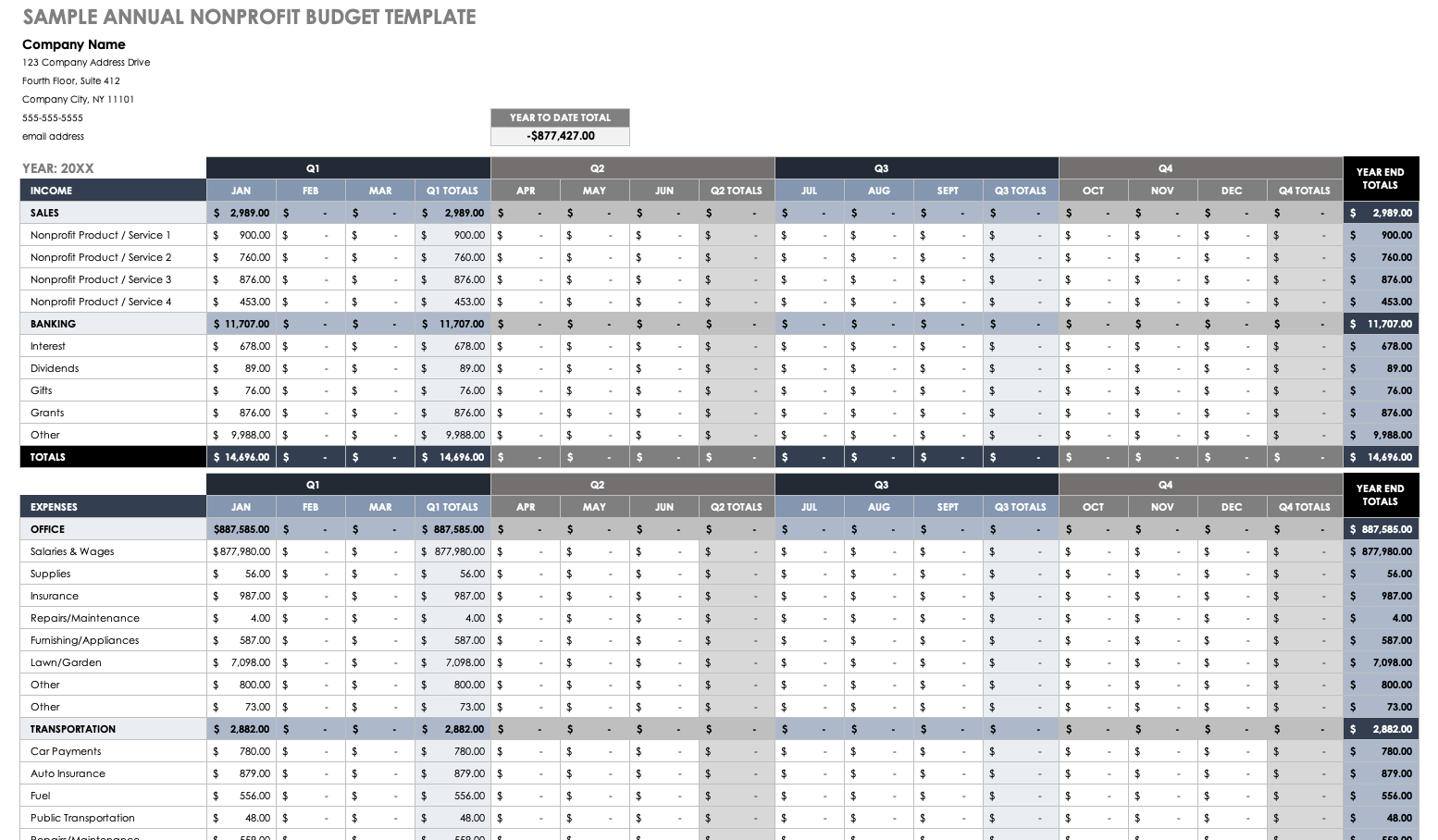

Image Source: smartsheet.com

Gather Necessary Data

Once you have a clear understanding of your nonprofit’s goals, it’s time to gather the necessary data to create your budget. This includes:

Past financial records: Review your organization’s previous year’s income and expenses.

Create a Budget Template

A typical nonprofit budget template includes the following sections:

1. Income Statement

Revenue: List all your expected income sources and their estimated amounts.

2. Balance Sheet

Assets: List your organization’s assets, such as cash, investments, property, and equipment.

3. Cash Flow Statement

Cash inflows: List your expected cash inflows from donations, grants, and other sources.

Tips for Creating a Comprehensive Budget

Be realistic: Avoid overestimating your income or underestimating your expenses.

Conclusion

A well-crafted nonprofit budget is a valuable tool for managing your organization’s finances and achieving your goals. By following the steps outlined in this guide, you can create a budget that accurately reflects your nonprofit’s financial situation and helps you make informed decisions.

FAQs

1. How often should I update my nonprofit budget? It’s generally recommended to update your budget at least quarterly, or more frequently if your organization’s circumstances change significantly.

2. What is the difference between a budget and a financial statement? A budget is a plan for future income and expenses, while a financial statement is a report of past financial performance.

3. Can I use a generic nonprofit budget template? While a generic template can be a good starting point, it’s important to customize it to your organization’s specific needs and goals.

4. How can I ensure that my budget is accurate? To ensure accuracy, gather reliable data, involve your staff and board members, and regularly review and adjust your budget.

5. What are some common budgeting mistakes that nonprofits make? Common mistakes include underestimating expenses, overestimating income, and failing to include contingency funds.

Nonprofit Budget Template